Reinforcement activity 2 part a accounting – Reinforcement Activity 2 Part A in Accounting delves into the intricacies of this crucial process, providing a thorough understanding of its components, procedures, benefits, challenges, and best practices. Through detailed explanations and real-world examples, this exploration unravels the significance of reinforcement activity in enhancing accounting practices.

This comprehensive guide unravels the multifaceted nature of Reinforcement Activity 2 Part A, illuminating its key components, step-by-step procedures, and the advantages it offers in strengthening accounting practices. By examining potential challenges and limitations, along with strategies to overcome them, this analysis equips readers with the knowledge and tools necessary for effective implementation.

1. Definition and Overview: Reinforcement Activity 2 Part A Accounting

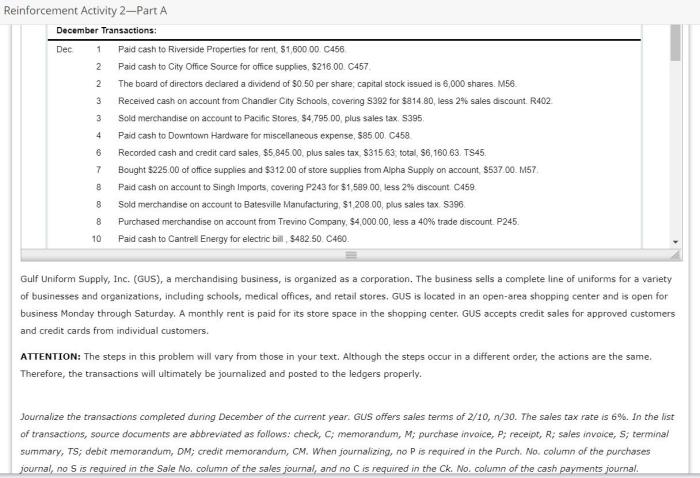

Reinforcement activity 2 part a in accounting refers to the process of reconciling the subsidiary ledger to the control account. It involves comparing the balances of individual subsidiary accounts with the balance of the corresponding control account to ensure their accuracy and completeness.

This process is crucial for maintaining the integrity of accounting records and detecting any potential errors or discrepancies. By performing reinforcement activity 2 part a, accountants can ensure that the subsidiary ledger and control account balances match, providing confidence in the reliability of the financial statements.

2. Components of Reinforcement Activity 2 Part A

Reinforcement activity 2 part a consists of several key components:

- Control account:The account in the general ledger that summarizes the balances of all subsidiary accounts.

- Subsidiary ledger:A collection of individual accounts that provide detailed information about specific transactions or activities.

- Trial balance:A report that lists all the account balances at a specific point in time.

- Adjusting entries:Entries made to correct errors or adjust account balances to reflect the actual financial position of the company.

Each of these components plays a vital role in the reinforcement activity 2 part a process.

3. Procedures for Reinforcement Activity 2 Part A

The procedures for performing reinforcement activity 2 part a are as follows:

- Prepare a trial balance of the subsidiary ledger.

- Compare the total balance of the subsidiary ledger to the balance of the control account.

- If the balances do not match, investigate the differences and make any necessary adjusting entries.

- Prepare a new trial balance of the subsidiary ledger to verify that the adjustments have been made correctly.

- Ensure that the new trial balance balances to the control account.

These procedures should be performed regularly to ensure the accuracy and reliability of the accounting records.

Essential Questionnaire

What is the primary objective of Reinforcement Activity 2 Part A in accounting?

Reinforcement Activity 2 Part A aims to strengthen internal controls, enhance the accuracy and reliability of financial reporting, and promote compliance with accounting standards.

How does Reinforcement Activity 2 Part A contribute to improved accounting practices?

By identifying and addressing weaknesses in internal controls, Reinforcement Activity 2 Part A helps prevent errors, reduce fraud risk, and improve the overall quality of accounting information.

What are some common challenges associated with Reinforcement Activity 2 Part A?

Challenges may include resistance to change, resource constraints, and the need for ongoing monitoring and evaluation to ensure effectiveness.

How can organizations overcome the challenges of Reinforcement Activity 2 Part A?

Effective communication, training, and collaboration among stakeholders, along with regular reviews and updates, can help organizations successfully implement and sustain Reinforcement Activity 2 Part A.